Metasploit AV Evasion

Metasploit payload generator that avoids most Anti-Virus products.

Released as open source by NCC Group Plc

Developed by Daniel Compton at NCC Group Plc

Released under AGPL see LICENSE for more information

Removed Deprecated Commands in favor of MSFVenom

Updated 12/2015

Removed use of ifconfig for more Distro Compatibility, Using ip route for ip Detection.

Added gcc compiler use condition for use in Arch Based Distros.

Using msfconsole -x for auto Listener launching instead of resource file.

Code Cleanup.

Tested on Kali Linux.

Website: www.jsitech.com

GitHub: github.com/jsitech

Twitter: @JsiTech

Install and Run:

Features:

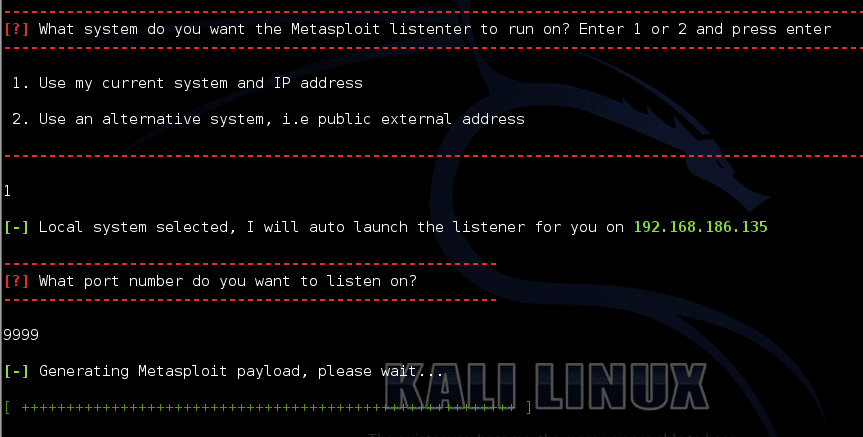

* Easily generate a Metasploit executable payload to bypass Anti-Virus detection

* Local or remote listener generation

* Disguises the executable file with a PDF icon

* Executable opens minimised on the victims computer

* Automatically creates AutoRun files for CDROM exploitation

Screenshots:

Thursday, 2 August 2018

Metasploit AV Evasion - Create Metasploit payload can bypass Anti-Virus

Labels:forex, iqoption, pubg Hacked

linux

Terminator - Easy way to create Metasploit Payloads

Payload list:

Binaries Payloads: Android, Windows, Linux, Mac OS

Scripting Payloads: Python, Perl, Bash

Web Payloads: ASP, JSP, War

Encrypters: APK Encrypter, Python Encrypter

The author does not hold any responsibility for the bad use of this tool, remember that attacking targets without prior consent is illegal and punished by law.

Note: The payload created will be saved in the Terminator folder

Install and Run:

Labels:forex, iqoption, pubg Hacked

linux

Wednesday, 1 August 2018

Technical analysis to Forex

Technical analysis to Forex

Technical analysis is the study of historical and graphical data so that traders can perform their operations more consciously.

Keep in mind that past performance is not always a reliable indicator of future performance.

There are 3 basic types of trends:

First, you need to define the type of negotiator / investor you are. You must decide whether you want to work for a long time or buy and sell quickly. This decision will determine the graphics to use. Day traders, or those who invest and leave their positions quickly, use daily and intraday charts more than investors who buy and hold for a long time.

Levels of support and resistance

A support level may be the previous minimum. The resistance level could be the highest point of the previous day, or better known as the maximum. After breaking a resistance level, it usually becomes a support level if the negotiated instrument falls again. When the instrument goes down and breaks the support, it becomes the new minimum. In other words, if the instrument floats above the resistance index, it becomes the new maxim.

Stroke

Plots are percentages. Throughout the day (open to markets), the instrument you observe or invest will normally trace the activity of the day before. It does not matter if it's high or low. The most commonly used is fifty percent. We also use levels of one third, 38% and 2/3.

Trend lines

The simplest way to begin your analysis is to learn and apply trend lines. The first thing to do is to draw a straight line that connects two points on your graph. To display an increasing trend line, connect two minimums on one line and, for a decreasing trend line, connect two maximums. You will notice that, generally, the market (price) will pull a trend line before resuming a trend. When the price exceeds a trend line, it's the end of a trend. The longer the trend line, the more it has been tested and the more important it is. Keep in mind that the trend line becomes valid when the market touches it 3 times.

Moving averages

When looking at buying and selling signals, you should look at moving averages. These stockings will tell you if the current trend is still at stake. Caution: do not plan a change of trend. Operators generally use two moving averages. Moves above and below 20- and 40-day averages are very popular. 5 and 20-day averages are very popular for those who trade quickly

Oscillators

In order to identify the conditions bought or sold in excess of the markets, oscillators are commonly used. They often alert an operator that the market has gone up or down too much and that a change is imminent. The relative strength index or RSI and stochastic are the most popular oscillators that an operator will use. Now, these scales range from 0 to 100. The RSI: if the scale is greater than 70, it means that it is too much bought. If the scale is less than 30, it is sold too much. For stochastics, excess purchases are 80 and 20 are sold in excess.

Technical analysis is the study of historical and graphical data so that traders can perform their operations more consciously.

Keep in mind that past performance is not always a reliable indicator of future performance.

- Open a demo account

- Open a real account

There are 3 basic types of trends:

- Short term

- Middle term

- Long-term

First, you need to define the type of negotiator / investor you are. You must decide whether you want to work for a long time or buy and sell quickly. This decision will determine the graphics to use. Day traders, or those who invest and leave their positions quickly, use daily and intraday charts more than investors who buy and hold for a long time.

Levels of support and resistance

A support level may be the previous minimum. The resistance level could be the highest point of the previous day, or better known as the maximum. After breaking a resistance level, it usually becomes a support level if the negotiated instrument falls again. When the instrument goes down and breaks the support, it becomes the new minimum. In other words, if the instrument floats above the resistance index, it becomes the new maxim.

Stroke

Plots are percentages. Throughout the day (open to markets), the instrument you observe or invest will normally trace the activity of the day before. It does not matter if it's high or low. The most commonly used is fifty percent. We also use levels of one third, 38% and 2/3.

Trend lines

The simplest way to begin your analysis is to learn and apply trend lines. The first thing to do is to draw a straight line that connects two points on your graph. To display an increasing trend line, connect two minimums on one line and, for a decreasing trend line, connect two maximums. You will notice that, generally, the market (price) will pull a trend line before resuming a trend. When the price exceeds a trend line, it's the end of a trend. The longer the trend line, the more it has been tested and the more important it is. Keep in mind that the trend line becomes valid when the market touches it 3 times.

Moving averages

When looking at buying and selling signals, you should look at moving averages. These stockings will tell you if the current trend is still at stake. Caution: do not plan a change of trend. Operators generally use two moving averages. Moves above and below 20- and 40-day averages are very popular. 5 and 20-day averages are very popular for those who trade quickly

Oscillators

In order to identify the conditions bought or sold in excess of the markets, oscillators are commonly used. They often alert an operator that the market has gone up or down too much and that a change is imminent. The relative strength index or RSI and stochastic are the most popular oscillators that an operator will use. Now, these scales range from 0 to 100. The RSI: if the scale is greater than 70, it means that it is too much bought. If the scale is less than 30, it is sold too much. For stochastics, excess purchases are 80 and 20 are sold in excess.

Labels:forex, iqoption, pubg Hacked

Forex,

Investment,

money,

Tips,

Trading

EASY ONAIR Latest ( IPTV + MULTICHANNEL NDI )

EASY ONAIR

4K/HD/SD Automated Playout and Graphics with Streaming

Drag, Drop and Play any Video Files Instantly

You can easily add your files by drag and drop method directly anywhere on playlist from file explorer of OS to content field. There is no restriction on number of media files added to the playlist of playout.

Playout Outputs; 4K, UHD, HD, SD and IP

Playout can provide UHD 12G or Quad 3G SDI output beside HD, SD output, concurrently can provide IP output while providing conventional output. IP outputs can be RTP/UDP as constant bit rate for broadcast IP multiplexers, or as RTMP output to any CDN, social media or YouTube live.

Integrated CG Can Be Used for Logo, Ticker, SMS, Animated Movies, Clock and Timer

Playout has an CG render server inside. It provides animation, crawl, roll, video, video with alpha channel, picture, picture sequences, clock or any interactive CG items can be included in playout automation.

Virtually Trim/Split Files, Select and Independently Listen to any of the 16 Channels of Audio

Playout trim window provides editing on a video can be as virtually to trim or split into files on playout. Select and independently listen to any of the 16 channels of audio beside audio tracks.

Run up to 16 SD Channels with Graphics in a Single Box

Easy OnAir playout automation has a powerful performance, which provides a unique property and stability to it. 4K playout automation, 8 HD channels playout or 16 SD channels playout run conveniently in suitable environment.

Mix multiple codecs, resolutions, audio sample rates and aspect ratios in one playout

Easy OnAir playout helps users to mix different codecs, resolutions, audio sample rates, frame rates and aspect ratios in one playlist. User just select output resolution and frame rate; it provides auto up-down convert in real time.

Stream Output as UDP, RTP in H264 or MPEG-2 as HD or SD in ATSC/DVB or Web Usage

EMS can provide stream output to any IP multiplexer or IP Decoder as Constant Bit Rate in UDP or RTP protocol. H264 or MPEG-2 codec as HD or SD in ATSC/DVB. Beside broadcast IP output, playout can be used also as web or social media playout with the help of RTMP output to any CDN, social media and YouTube live

Labels:forex, iqoption, pubg Hacked

Cable TV Playout Software,

Catv max Player,

CG Editor,

Indian Software,

Pakistani Software,

Web TV Streaming

Subscribe to:

Comments (Atom)